This article is the traslation of Mr. Ikehaya’s blog, translated by Jun who is the member of ICL α group.

>>Join ICL

Hello, my name is Ikehaya.

I thinking the way to bring up additional excitement of Japanese NFT market on 2023.

”NFT project with low mint price & low listed rate” is strong.

Let’s look at the market as it is the beginig of New year.

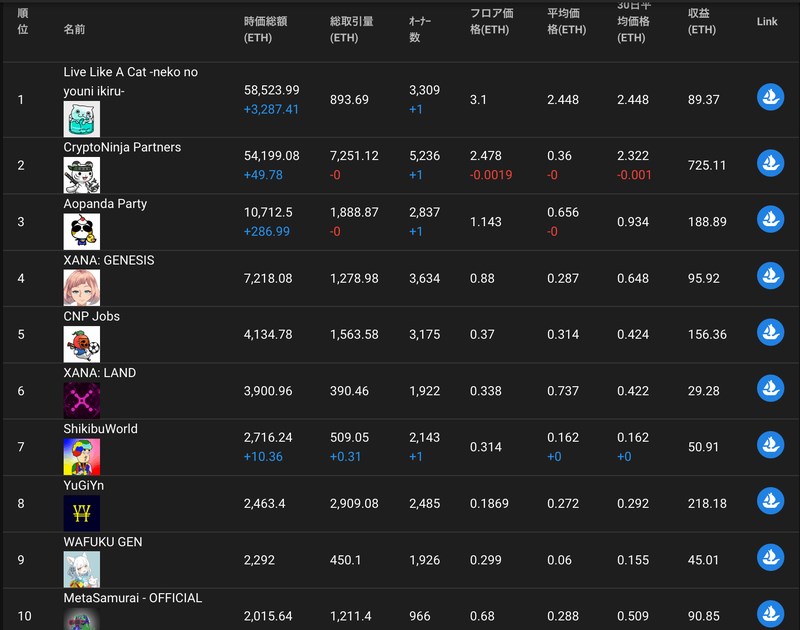

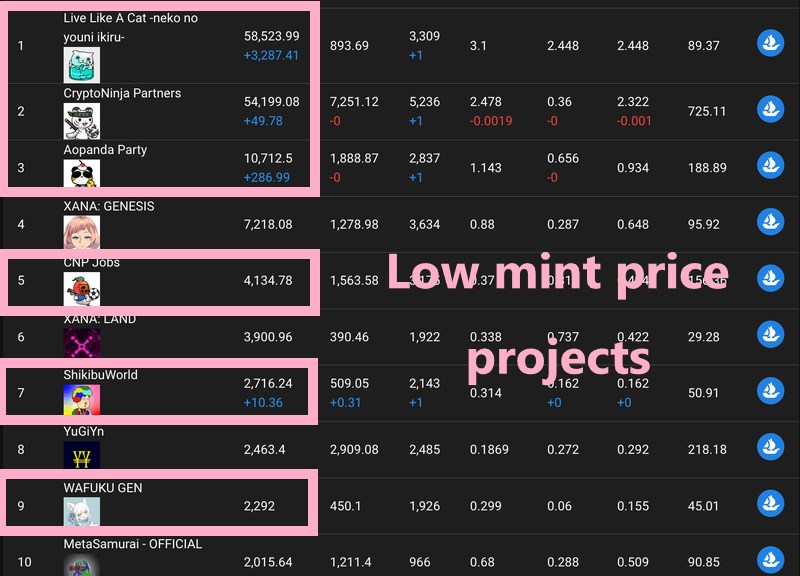

I would like you to pay attention to those projects in Japan in Top 10.

As you can see, a lot of projects that are high on the list started with low mint price.

In addition, these projects have low listed rates.

Below are the listed rate including project managment’s holded NFT.

- LLAC : 0.9%

- CNP : 0.8%

- APP : 0.8%

- CNPJ : 2.6%

- ShikibuWorld:1.8%

- WAFUKU GEN:1.6%

Especially, Top 3 projects “CNP, APP, LLAC” are outstanding !

Even though those price are sharply hiking, a lot of people don’t list those NFT.

No need to say, lower list rate has benefits.

In order to continuously build brand value, it is better to have people with diamond hand (Gachiho) for having daily excitment in the community and create next development.

CNP owner’s app that is played by over 2,200 people are a good example.

スマホアプリ「CNP Friends」

— 【公式】CNP(シーエヌピー) | CryptoNinja Partners (@cnp_ninjadao) January 2, 2023

ユーザー数2200名突破 🎉

お正月も1万歩超えの方がたくさん🚶🚶♀️

2023年もどうぞよろしくお願いします🐰

アプリについてはリプ欄から⬇️#CNP pic.twitter.com/O5j1Fp6uVN

More attractive developments for owners of NFT creats more diamond hands (Gachiho) people which is attractive for investors as well.

High volitility is one of the attractiveness of diamond hands (Gachiho) which is often overlooked.

Low list rate benfits short term trade

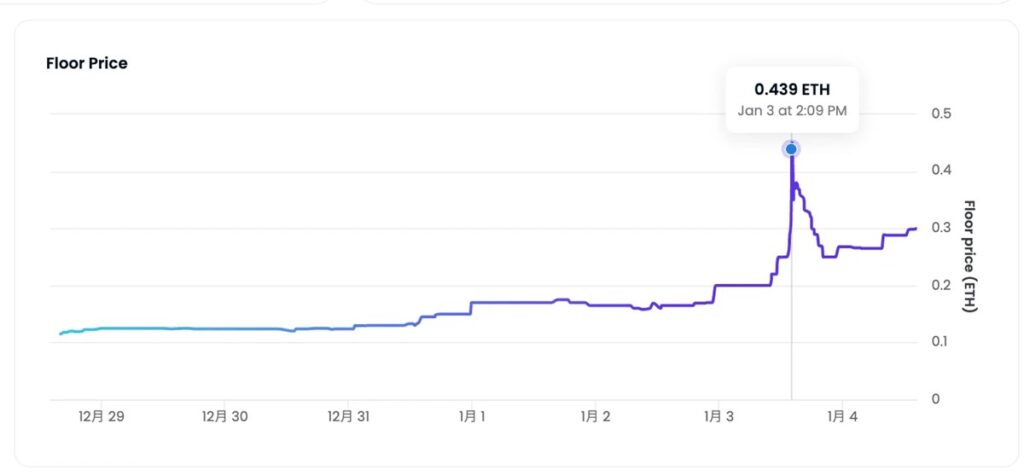

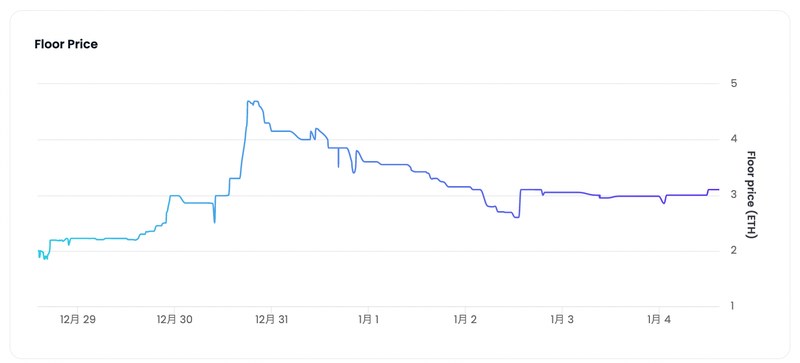

“WAFUKU GEN” project chart yesterday is a good example.

I will explain what is happening as it is a bit difficult to understand.

- In several days, the price were going up gradually.

- Sudden hike on 3rd Jan. From 0.2ETH, the NFT were bought and went up to 0.439ETH.

- Because of the price hike, the listed rate went up and the price went down to 0.25ETH.

- Now, the price is stable around 0.3ETH.Gradually,

This is what happend to WAFUKU GEN.

The point is, “the price of WAFUKU GEN went up double momentarily”. The tradors took quite a bit befit who acted well at the time.

The reason of the sudden price hike of WAFUKU GEN is because of the low listed rate they originally had.

In short, WAFUKU GEN price smoothly went up because the listed NFT were few.

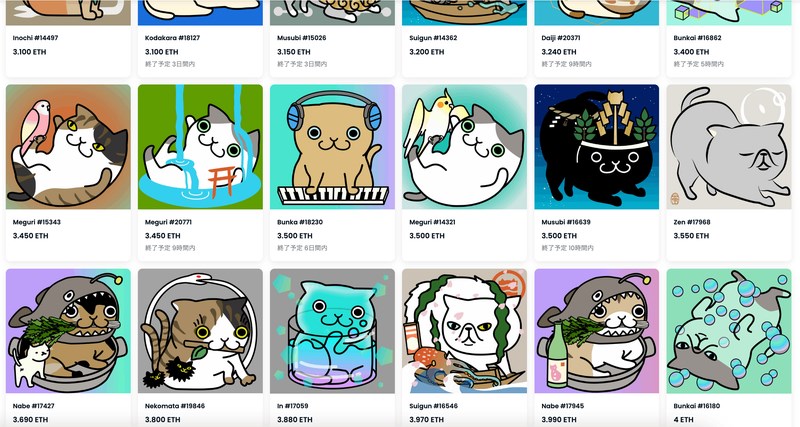

LLAC are listed extremely low. The floor price will sharply goes up if 10 NFT were sold. If 20, to the moon.

On the other hand, this volatility won’t happen for those projects have high listed rate (5~10%).

In my experience, the price goes back at most 20% because they cannot absorb the additional NFT that will be listed.

My point here is, NFT projects that have low list rates are attractive for short term traders.

In other words, NFT that has Diamond hands (Gachiho) people is attractive for those short term traders to earn money.

“Gachiho NFT” will draw attention on 2023

As it is already started, it is not my prediction…

Certain amount of money will be gathered to “Gachiho NFT” on 2023 unless Japan NFT market becomes bubbly.

“Gachiho NFT” won’t matter, if bubble comes to Japan NFT market.

Actually, the price of some NFT abroad went up sharply even though they were listed over 15% at Opensea. In short, strong market which can absorb NFT selling came around.

Now, in Japan, there are only about 15K NFT buyers and as you know, crypto market is facing downturn in market place globally.

For 2023, I believe the trend will not change drastically, so investors and traders will prefer “Gachiho NFT” that

- expected to have long term developement and strong community

- can constantly expect price increase because of the low list rate

- can generate profit by local volatility spikes

Low mint price NFT are effective to be hodled (Gachiho)

Let’s continue.

Actually, I think mint price have a high correlation with Gachiho (Diamond hand) rate.

As you can see from the result, “Gachiho NFT” tend to be low minted price NFT. The only exception is “XANA : GENESIS”.

Why low minted price NFT can be “Gachiho NFT” ?

Because, initial investors don’t need to recover their capital.

For instance, LLAC mint price was only 0.001ETH (about 160JPY). Needless to say, you don’t need to think about the invested amount of money for the mint.

If, the mint price was 0.08ETH (about 13,000JPY), and you minted 3 NFT, a lot of investors will try to recover their initial cost they used for the mint.

For the one who minted 3 NFT, he can recover his initial cost selling 1 NFT, if the price goes up to 0.3ETH.

For the one who minted 2 NFT, 0.2ETH will do to get his invested money back.

Thus, those projects will have strong selling order or profit taking around 0.2~0.3ETH.

I hope there were more demand to break through the strong sell of NFT, but I think difficult with the current weak crypto market.

However, in case of low mint price NFT goes up smoothly because they don’t need to recover the initial cost.

LLAC is good example that exceeded 4ETH in the initial stage after the mint.

I guess the price hike stopped around 0.3ETH if the mint price was 0.1ETH. If so, LLAC wouldn’t have achieved the current floor price (3ETH).

How to launch low mint price NFT without giving them to paperhands

So, looking at the current market, it seems “lauching low mint price NFT is good”

Of cource this is about tendency as there are NFT successful project like XANA : GENESIS that was not minted in low price.

And also looking at the market, not all projects are successful even they are minted in low price.

The conditions are

- low mint price

- low listed ratio

- have constant demand

Fulfilling these aspects, I think the project will be like “Gosanke” (top 3 projects in JP) brand.

The difficulties for the projects are to have No. 2, low listed ratio. For No. 3 I will exclude it to explain as it is obvious that every projects need it.

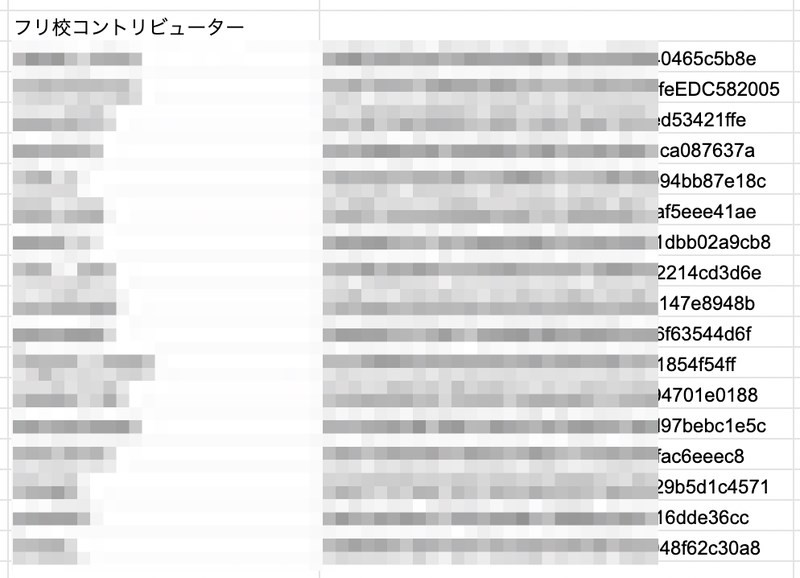

I did a crazy work to exclued all the paper hands from the AL.

I have checked all the list of AL one by one but couldn’t kick out all the paper hands.

However, there is no doubt that we have achieved certain success, and a lot of people realized that “excluding paper hands are important”.

Thus, from now on, many NFT marketers of “low mint price NFT project” are going to have a hard time thinking about “how to launch NFT projects without giving AL to those paper hands“.

Why not giving AL to those “Gachiho” (Diamond hands) people

I will give the answer for NFT marketers.

If you want to remove paper hands from your projects AL list, you can give AL to those people who have diamond hands (Gachiho) for current existing projects.

Actually, this is what LLAC project did.

LLAC project gave AL to those people who have hodled CNP & APP. Not perfect but felt effective enough.

But with this way, there will be some criticism claiming that “in that way, new person or rookies for NFT or communities cannot get AL !”.

In that case, you can give AL to members evaluating there activities in the community.

In case of LLAC, we gave pretty much AL not only to CNP or APP hodlers but to “contributors” in LLAC community.

Of cource, those contributors are not paper hands and have been hodling LLAC after the mint !

(No doubt that you can sell them when necessary)

But, increasing too much AL for contributors will damage the community cause many people starts to chase AL in the community.

Basically, it’s difficult to give much AL to those members in the community, so I recomment giving AL to some members who you can trust.

Test case of giving AL to Top 3 projects (Gosanke) in Japan

When I was thinking about AL like above, I got a collaboration request from XANA about PENPENZ.

PENPENZ is actually the project of low mint NFT (0.001ETH) !

As already mentioned by Mr. Rio, the project will carefully sellect who to give AL.

#XANAPenpenz #AL will be one of the rarest allowlist ever which owners can be proud of the passion and dedication into this #web3 #metavese

— Rio Noborderz (@rio_noborderz) January 3, 2023

NFTほど持つ人を選ぶ、持つ人が見えるプロダクトは他になく、だからこそ可能性に満ちたコミュニティができる。#XANAhttps://t.co/VoD3tpcljv

This is a very good chance to test some of the hypothesis…

So, we are planning to give AL of PENPENZ to all the members of ICL who have top 3 projects NFT.

Basically, you can consider this as confirmed AL but might be lottery just in case.

XANA project will distribute AL with other ways as well. You can be relieved as the number of those owners of Top 3 projects NFT are not enough to fulfill the AL number we want to give.

CNP, APP, and LLAC, top 3 NFT projects of market cap in Japan.

This is a test of checking the attitude of those top 3 projects hodler. This include experiment of how you treat PENPENZ, so please do not appy AL if you don’t want to join the experiment lol.

I think there will be more and more cases for hodlers. You have more chances to get other low mint price NFT, if you hodl “Gachiho NFT” (diamond hand NFT). Zazen !

“Gachiho” culture plan (diamond hands culture plan)

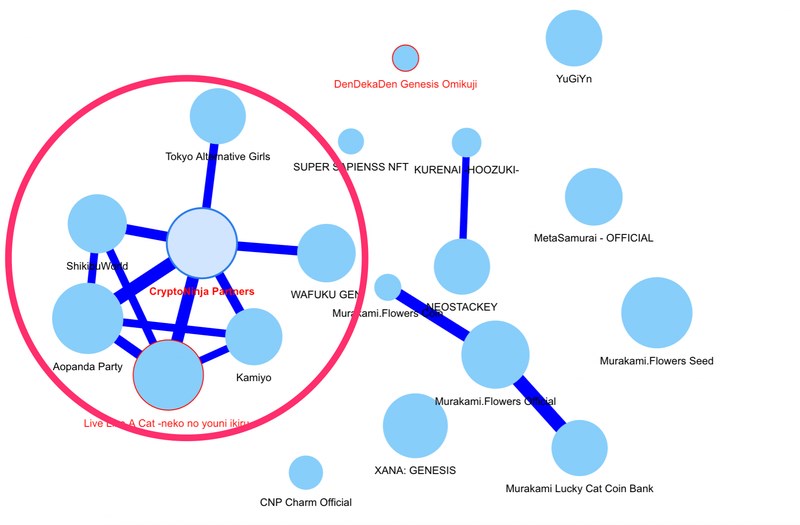

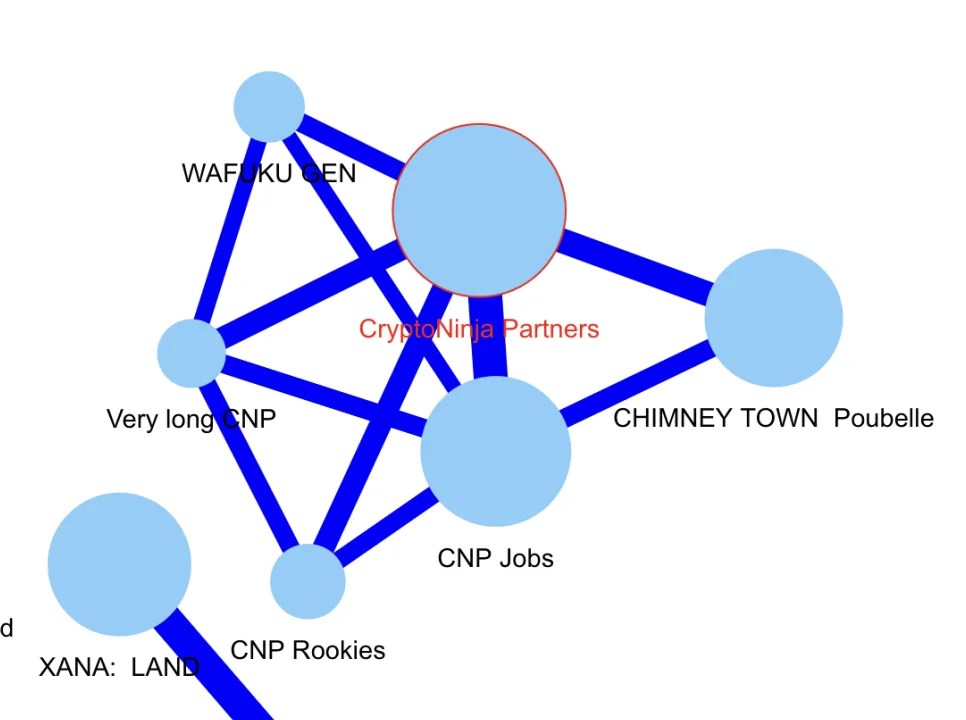

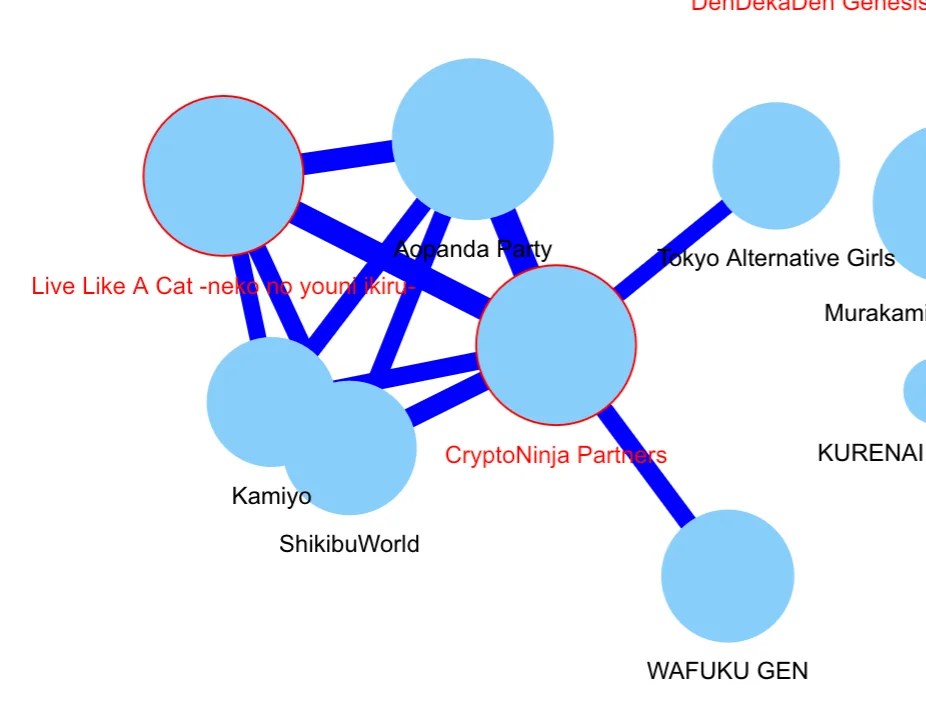

Correlation diagram you can see at oneseep is very very interesting.

This diagram shows NFT holders who have multiple NFT.

As you can see, holders who have CNP also have APP, LLAC, WAFUKU, KAMIYO, ShikibuWorld and TAG.

It is interesting that CNP is in the center of the diagram and have the strongest connection with other NFT projects.

BTW, all of these projects are low mint price NFT and have low listed rate in OS. Don’t you think this is extremely interesting ?

Interestingly, low mint price NFT holders has other low mint price NFT. It is not only related to how the projects give AL.

You can see that there are “Gachiho culture sphere” around CNP.

As you can mint them with low price, no hesitation for the mint. And as you don’t need to recover the investment, people tend to enjoy hodling NFT without selling them.

My target this year is to expand this “Gachiho culture sphere”.

On 2022, the “Gachiho culturer shpere” was still small. Below is the screenshot of the end of Oct before APP was released.

And now again, below is the current diagram. The impact of APP and LLAC are big ! WAFUKU, KAMIYO, TAG and Shikibu are also standing out.

BTW, “Gachiho culture shpere” do not exist abroad.

I am sure that this cultural sphere looks attractive for foreign investors.

Actually, they like this Japanese diamonda hand (Gachiho) culture. You can read Mr. Apesian’s explanation.

With the recent boom in the Japanese NFT market, many have reached out to me asking what’s happening.

— Apesian アトザ | NFTAsian.eth | based 🇯🇵 (@TheNFTAsian) November 18, 2022

Having being active in the Japanese NFT space since its infancy back in August 2021, I want to share some insights.

Here’s why Japanese NFT buyers tend to diamond hand NFTs:

Summary

- Low mint price & low listed rate NFT (like CNP, APP, LLAC) have high market cap & floor price in current market.

- Low listed rate NFT price tends to rise because of low sell power

- Low listed rate NFT have an advantage for short term tradors as they have volatility

- Holders of low mint price NFT don’t sell because they don’t need to recover their investment

- However, low mint price will be the target of paper hands. So, not all low mint price NFT goes well.

- LLAC intensively gave AL to CNP and APP owners that has diamond hands records.

- Planning to give AL of PENPENZ to Top 3 projects holders (CNP, APP, LLAC)

- “Gachiho culture” (diamond hand) sphere is the strengh of Japanese NFT market.

If bubble comes to Japan market, we don’t need to consider this troublesome strategy or outlook of the market, as I have written in the article already.

But we don’t know if bubble are going to come or not. For now, we need to build stronger NFT market in Japan.

Let’s pump Japan NFT market together on 2023 as well !

>>Join ICL